Industry Insights

2022 Market Outlook

January 2022

- 2021 was another challenging and disruptive year for public health and global trade.

- Despite pandemic-driven dislocations, supportive government policies propelled most economies and “risk assets” higher.

- With the potential for recent tailwinds to become headwinds, how should investment portfolios be positioned going forward?

Review of 2021

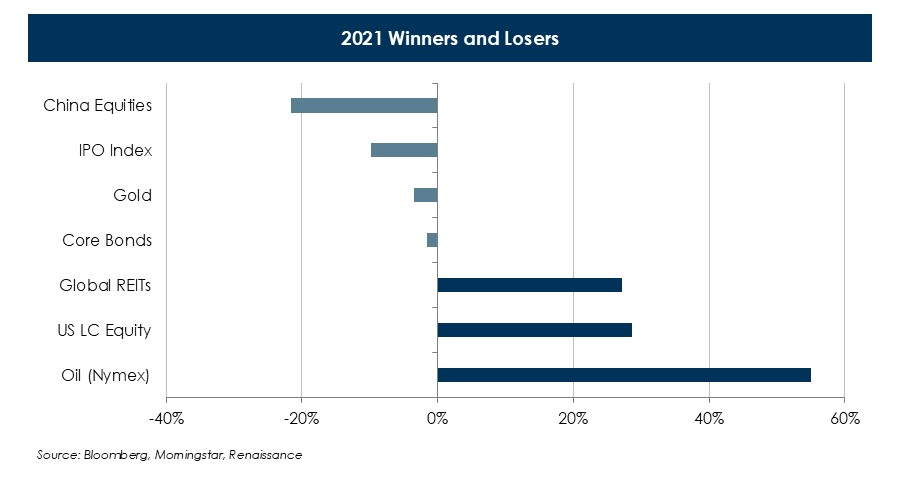

The ongoing government policy backstop along with progress toward herd immunity from the Covid pandemic boosted sentiment and asset prices in 2021. However, supply chain constraints and labor market irregularities caused an unexpected spike in inflation. Nonetheless, investors generally benefitted from a surge in financial assets tied to the cyclical recovery (oil, US stocks, and real estate). Traditional “safe” assets (core bonds) and inflation hedges (gold) lagged. IPOs, which were big winners in 2020 reversed course in 2021, while Chinese equities also declined following ongoing regulatory tightening by the CCP.

.JPG)

Key themes in 2022

- Enduring economic recovery - new Covid variants may be disruptive in the short-term, but society has found ways to adapt to the pandemic and economic growth is expected to remain above trend next year, returning to trend in 2023/4.

- Potential disinflationary surprise – as the pandemic recedes, supply chains and labor markets should stabilize, allowing inflation to gradually move back toward the Fed’s 2% target. This should lead the Fed to raise rates more slowly than feared in 2022/3. The Fed’s recent “hawkish” tilt suggests a 0.88% Fed Funds Rate by the end of 2022, still very low historically.

- Focus on corporate earnings and equity valuations – through the first half of 2022, higher wages and raw materials along with modestly higher interest rates could start to impact profit margins. However, an improving labor market should also support consumer spending and drive revenue growth.

- China’s growth trajectory – China’s ongoing clampdown on industries/sectors not aligned with the government’s “common prosperity” campaign could result in a sharper slowdown than expected. Specifically, the property market downturn and zero Covid tolerance approach have clouded China’s near-term growth outlook. In response, certain restrictive policies have been reversed, demonstrating that China is eager to restore confidence and remain the key driver behind global economic growth.

- Ongoing risks – several far reaching issues are difficult to quantify, including potential cyberattacks, geopolitical shocks (China/Taiwan, Russia/Ukraine, Iran’s nuclear program), monetary policy overtightening, and a possibility of disruption as global economies shift to address climate change.

What are the implications for investment returns?

- Returns over the next 12 months are very difficult to predict with any degree of certainty.

- Over the next 10 years, low yields, moderating growth, and stretched valuations may weigh on overall portfolio returns.

- Inflation could remain elevated in 2022, but is expected to decline and average around 2.4% for the next decade.

- Traditional equities are still expected to generate positive real returns and active management should add value.

- Traditional fixed income still faces headwinds from low/rising rates and could struggle to beat inflation.

- Return potential may be enhanced with allocations to non-traditional asset classes including private debt, private equity, and private real estate.

ACG’s Position

Given the prospect for lower real returns over the next decade, investors may be inclined to chase recent winners. We believe that maintaining a more strategic approach with a focus on the long-term is likely to keep investors’ expectations and results aligned. Non-traditional assets, with higher return potential, should be evaluated for suitability based on each client’s investment objectives, and consideration should be given to liquidity management if incorporating more private assets to avoid any forced liquidations during periods of market stress.