Industry Insights

2024 Presidential Election – Comparing Fiscal Agendas

April 2024

- The 2024 Presidential election is set as a rematch between current President Joe Biden and former President Donald Trump

- Each candidate’s fiscal priorities have already been on display in their first terms and give insight into second-term agendas

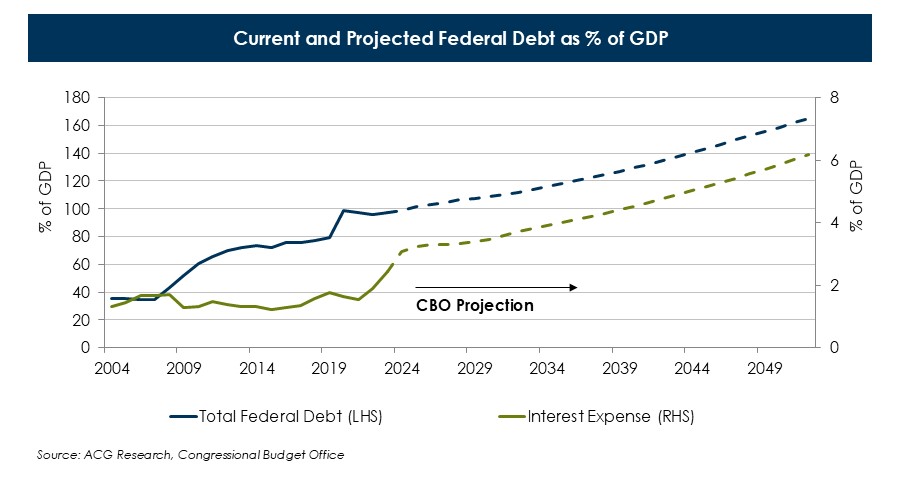

- Growing borrowing costs for the treasury are putting a greater burden on the federal budget and could constrain spending

A Unique Election

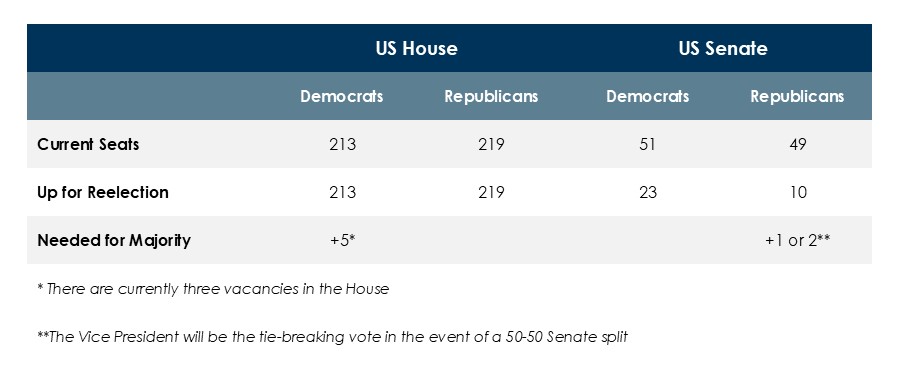

With both candidates having clinched their respective primaries, the 2024 Presidential election matchup is set as a rematch between incumbent President Joe Biden and challenger Donald Trump. Given the unusual circumstances of both men having already been president, each candidate now has a track record that gives insight into what a 2nd term agenda could look like.

Covid relief aside, each candidate oversaw significant fiscal policy legislation in their respective first terms. Trump’s signature piece of legislation was the Tax Cuts and Jobs Act (TCJA), which ushered in some of the largest changes to the US tax system since the 1980s. The act reduced tax rates for businesses and individuals and modified deductions, tax credits, and the alternative minimum tax. However, much of the law is set to expire after 2025.

Biden entered office with an ambitious spending plan called “Build Back Better” that was motivated by the sense of crisis from the pandemic. Many of his priorities failed to make it into law, but he did find some success in areas of bipartisan agreement such as infrastructure spending and subsidies for semiconductor manufacturing. He also signed the Inflation Reduction Act (IRA), which invested in clean energy, agriculture, and conservation programs. The IRA also has tax credits for healthcare premiums that expire at the end of 2025.

Both candidates had a unified government for the first two years of their terms and a divided congress in the next two. Neither the TCJA or the IRA would have passed in a divided government, as both had zero opposition support. They also required use of the budget reconciliation process to bypass the Senate filibuster, which does not allow a bill to increase the long-term deficit and is the reason for the eventual expiration of parts of both bills.

.jpg)

What Are the 2nd Term Priorities?

With multiple tax laws set to expire after 2025, major tax legislation is almost certain to be proposed regardless of who controls the presidency and Congress. A Trump priority would be the complete extension of the TCJA. Biden has vowed not to raise taxes on anyone earning less than $400,000 annually, which would require extending some Trump-era provisions. He would also like to expand healthcare, child, and mortgage relief tax credits. To help pay for these cuts Biden would seek to raise taxes on corporations and high earners. Each candidate’s goals would require cooperation from both houses of Congress. A divided government would increase the potential for a bargain, extending parts of the TCJA while also expanding other tax credits that Democrats seek.

Prospects for spending changes are more limited and dependent on control of congress. Trump’s White House budget proposals typically included large spending cuts but no major legislation was ever passed, and spending actually increased, even prior to the pandemic. Cuts would still presumably remain a goal, and a Republican-led congress under Trump would possibly tighten work requirements for federal benefits to help pay for tax cuts. Biden’s goals include parts of Build Back Better that have yet to pass such as universal Pre-K and paid family leave, but even with full Democratic control, additional spending would potentially have trouble garnering support from moderates.

What Is the Market Impact?

The backdrop of any fiscal legislation is different from both Trump’s first term and the first part of Biden’s term, with higher interest rates and a greater federal debt load. Deficit debates are ever-present in American politics, but lately the debt burden appears to be having a growing impact on financial markets. Treasury auctions have become heavily scrutinized for signs of weak demand, and the market’s struggle to absorb the increased issuance has likely contributed to higher bond yields. The optics of any legislation that isn’t at least deficit-neutral are politically challenging at a time when the Congressional Budget Office estimates that interest alone on the nation's debt will top $1 trillion a year by 2026. However, addressing the debt comes with a downside, as government spending is roughly 20% of GDP and any changes translate fairly directly to growth. Spending cuts or tax hikes would likely contribute to slower GDP growth.

.jpg)

ACG’s Position

Significant deficit reductions in the next presidential term are unlikely, as neither Trump nor Biden has shown much fiscal restraint. There will be a push to renew much of the TCJA regardless of election outcomes. Democratic control could result in higher corporate tax rates, but this would probably be paired with new tax credits and/or spending and not provide budget relief. Large fiscal stimulus is also unlikely in any election scenario given the need to contend with Senate filibuster rules and the increasingly burdensome debt situation. As a result, the next several years should see government contribution to GDP growth fade relative to the pandemic-era, but fiscal impulse is also unlikely to become contractionary.