Industry Insights

2024 Review and Market Outlook

January 2025

- Equity markets surged in 2024, propelled by the Fed cutting rates 1%, Tech/AI spending and bullish expectations for Trump 2.0

- Economies outside the US faced varying challenges including debt deleveraging, market fragmentation and low innovation

- Looking ahead, investors will have to balance their “fear of missing out” with the need for adequate downside protection

Review of 2024

The much-anticipated recession in the US did not come to pass, which resulted in fewer Fed rate cuts than the market had initially forecast. Economic resilience was driven by a tight labor market, robust consumer spending, advances in technology, and productivity growth. Global equity markets were higher across the board, but seven US mega-cap companies led the way as they benefitted from increasing demand for AI and related products and services. Fixed income returns were mixed, but generally positive on the year. Lower quality (high yield) bonds outperformed as spreads narrowed. Real estate continued to languish, particularly in the office sector, but stabilizing occupancies, higher capitalization rates, and a decline in fund redemptions suggest we may be nearing an inflection point.

Key Themes for 2025

- US Stronger for Longer – Key Trump initiatives: protectionism, ongoing deficit spending, corporate tax cuts, and deregulation should boost capital spending, reignite mergers and acquisitions activity, and extend the US economic growth cycle.

- Steepening Yield Curve – Historically, this has been an indicator of a stable/strengthening economy. As the short-end drifts lower with further expected Fed rate cuts, any growth acceleration could add upward pressure to longer rates.

- Ample Liquidity – Banks retreated from the loan market in recent years, increasing the need for private credit. The opportunity to achieve additional yield in non-traditional market segments created strong investor demand and led to tighter spreads. Money market balances also increased in 2024 from ~$6.3T to ~$6.8T, providing ample dry powder for deployment in the year ahead.

- Equity Valuations Broadly Intact – Outside of the “Mag-7”, which trade at a median 31x forward earnings, equity valuations still appear reasonable. Flows into passive funds could remain a challenge for active managers in the short-term, but fundamentals should favor stock pickers longer-term.

- Energy Demand – Surging demand for AI-related infrastructure, along with loosening regulations should favor investment in traditional and non-traditional power sources.

What are the Implications for Investment Markets?

- Recent tailwinds look to prevail in the near-term.

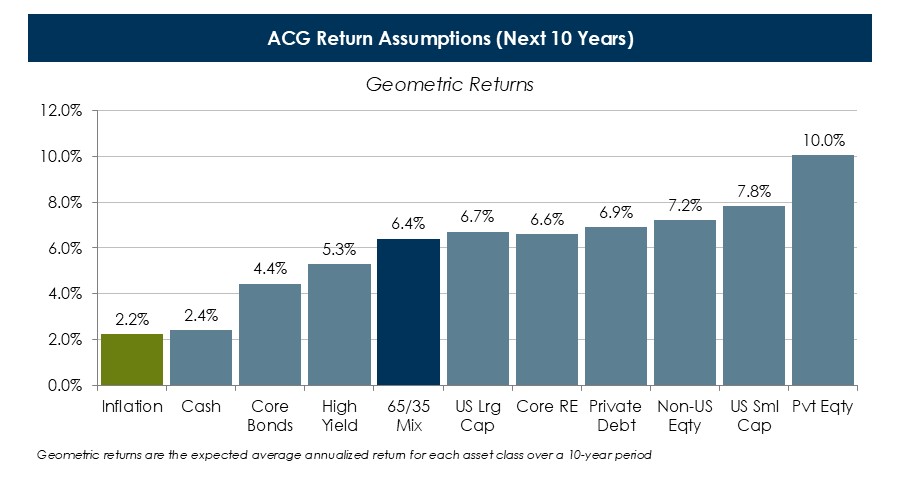

- Inflation, while potentially sticky in 2025 given Trump’s initiatives, is expected to continue decelerating toward the Fed’s target over the next decade.

- Traditional fixed income should provide solid real returns if yields and spreads remain range-bound. Private credit also remains attractive for investors comfortable with illiquidity.

- In public equities, valuations appear more attractive outside the “Mag-7”, with earnings and profit margin differentials (“Mag-7” vs. “S&P 493”) projected to narrow in 2025/26. Within non-US, emerging markets are preferred over developed.

- In other private markets (equity and real estate), fundamentals appear to be improving, as interest rates moderate and transaction activity picks up.

- Over the next decade, high federal debt, slowing economic growth, and potentially a higher neutral rate could lead to a moderation in overall portfolio returns vs. the prior decade.

Risks to Monitor:

- Inflationary pressure from deglobalization/nationalism

- Faster deceleration in China’s economy and knock-on effect

- Market concentration, driven by flows into passive strategies

- Investment product proliferation - interval funds, crypto, etc.

ACG’s Position

Given the S&P 500 Index’s back-to-back calendar year returns of ~25%, investors may be inclined to chase recent winners. We believe that maintaining a strategic approach, rebalancing periodically, and focusing on the long-term is likely to keep investors’ expectations and results aligned. Returns over the next 10-years could be lower than the recent period, but opportunities still exist across asset classes. When allocating to non-traditional, less liquid assets with higher return potential, strategies should be carefully underwritten for suitability based on each investors’ unique objectives, and consideration should be given to maintaining adequate liquidity to meet distributions and capital calls.

.jpg)