Industry Insights

2025 Market Review and 2026 Outlook

January 2026

- Global equity markets soared, led by stable economies, AI enthusiasm, and Fed rate cuts, but active management was challenged

- The continuation of the AI theme and decisions from Washington (Supreme Court tariff ruling, new Fed Chair) loom large over markets

- Elevated valuations are a market risk, but keeping focus on strategic targets remains the best way to achieve long-term portfolio goals

Review of 2025

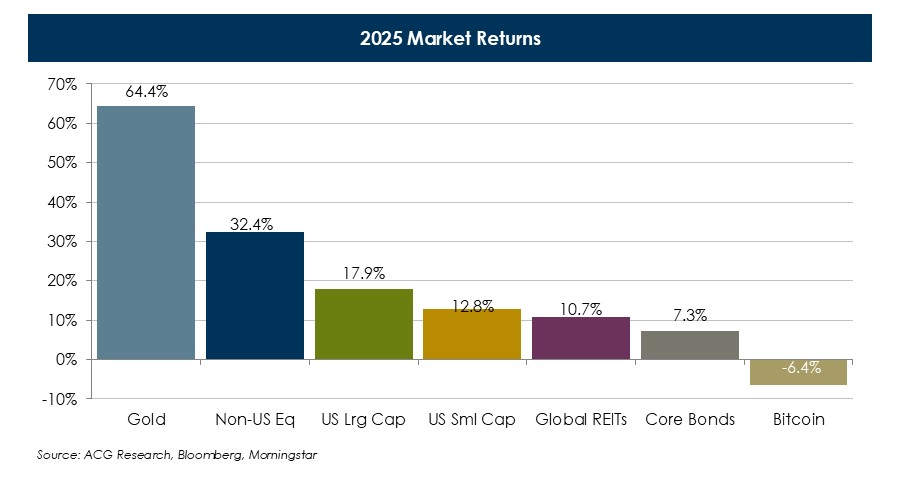

Policy uncertainty dominated markets to start 2025 but the US economy proved resilient as corporate fundamentals and earnings generally improved. Passive flows into index funds continue despite high valuations and retail “buy the dip” trading was pervasive as markets climbed to new all-time highs. The dollar lost value but retains its status as the world’s reserve currency. Trade wars led to a repatriation of assets out of the US back into home markets, as well as increased demand for store of value assets like gold and cryptocurrency (part of the so-called “debasement trade”). With inflation slowing and the labor market showing signs of weakness, the Federal Reserve resumed rate cuts which helped steepen the yield curve. Attractive all-in yields maintained the bid for credit, keeping spreads near record tight levels in both investment grade and high yield bond markets.

Even with strong market performance it was a difficult year for fundamentally driven active equity managers as many stocks looked priced to perfection. The ongoing AI buildout drove mega-cap tech companies and those adjacent to AI higher. Chip maker Nvidia led the charge, becoming the world’s first $4T company, then just three months later the first $5T company, though its competitors continue to challenge its dominance. AI-related start-up companies with little or no earnings (or revenues in some cases) were top performers in small cap indices regardless of the inherent difficulties in assessing their valuations.

.JPG)

Even with strong market performance it was a difficult year for fundamentally driven active equity managers as many stocks looked priced to perfection. The ongoing AI buildout drove mega-cap tech companies and those adjacent to AI higher. Chip maker Nvidia led the charge, becoming the world’s first $4T company, then just three months later the first $5T company, though its competitors continue to challenge its dominance. AI-related start-up companies with little or no earnings (or revenues in some cases) were top performers in small cap indices regardless of the inherent difficulties in assessing their valuations.

Key Themes for 2026

- AI Bubble? – traditionally asset-light hyperscalers (Meta, Alphabet, and Microsoft) are making massive investments into datacenters and chip manufacturing facilities to meet seemingly unlimited AI demand but so far have minimal current revenue to show for their efforts. The spillover effects of mega-cap investment in AI infrastructure have supported funding and valuations among AI-adjacent startups, many of which remain sensitive to assumptions around future adoption, revenue realization, and execution.

- Mounting Debt – fiscal stress is building as debt burdens grow both in the US and abroad due to burgeoning government spending. This pressures interest rates higher despite already rising debt service costs while tax cuts reduce revenue. Tariffs are a partial offset, but the legal status is being challenged.

- Fed Independence – Stephen Miran’s Fed Board seat re-opens at the end of January and could be reserved for President Trump’s next choice of Fed Chair. Current Chair Jerome Powell’s term ends in May, but his Board seat does not expire until 2028. The outgoing chair often resigns from the Board, but Powell may not do so. The President wants lower interest rates and Fed independence is being closely watched.

- The K-Shaped Economy – Headline unemployment is low but rising, and signs of softness in the labor market led to 75 bps of rate cuts. This may support the lower end consumer, whose wages have not kept up with costs of living, but risks reigniting inflation if it is a stimulus for higher income consumer spending.

- Active management challenges – Valuations are stretched thin across asset classes but a reversal of the tech/”non-earners” trade could benefit fundamentally driven stock pickers. Credit spreads remain near historic tights. Monitoring sectors and idiosyncratic opportunities is critical for fixed income.

Risks to Monitor:

- An AI bubble/devaluation, and corporate AI buildout issuance

- Stresses to energy infrastructure and the power grid

- Growing government debt and increasing budget deficits

- Tariffs and the impact on global trade, US/China tensions

- Low market breadth and high index concentration in Mag 7

- US policy uncertainty and “dollar debasement”

- Fed politics and pressure on both sides of the dual mandate

- Mounting concerns in the private credit and bank loan markets

ACG’s Position

Earning roughly a decade of typical S&P 500 returns over the past three years has understandably led some investors to question whether mean reversion is imminent. As Peter Lynch observed, "more money has been lost preparing for market corrections than has been lost in market corrections," a sentiment that feels particularly relevant in the current environment. We believe a disciplined, strategic approach focused on long-term objectives and supported by periodic rebalancing is more likely to keep investor expectations and outcomes aligned over time. While future returns are inherently uncertain, opportunities exist across asset classes within a diversified portfolio. Allocations to non-traditional or less liquid strategies should be evaluated for suitability based on each investor's objectives, risk tolerance, and liquidity needs, with consideration given to cash flow requirements, distributions, and potential capital calls.