Industry Insights

Deploying Cash into a Volatile Market

May 2022

- Liquidity soared in 2021, in part due to record amounts of dry powder in the private equity system and an accommodative IPO market.

- From an investment perspective, there is debate whether large distributions should be invested all at once or staged in over time.

- History suggests investors are better off deploying cash immediately, but in truth there is no one-size-fits-all solution for everyone.

2021: A Year of Record Liquidity

A confluence of factors led to a tremendous amount of distributions for investors and business owners alike in 2021. A few factors include:

• Potential changes in the tax code incentivized many business owners to seek a sale. US M&A activity reached records in terms of both volume (7,800+ transactions) and deal value ($2.6 trillion).

• Low yields and relatively calm markets increased appetite for IPOs. In fact, last year was the busiest year ever for new issues as more than 1,000 companies listed shares, raising over $300 billion (roughly 60% via SPACs and 40% via traditional IPOs).

What to do with all this cash?

On the surface large cash distributions should be celebrated. Often they represent the culmination of one’s lifelong work (e.g. selling a company) or the reward for providing equity capital to a private company (via direct investment or private equity fund). However, the capital needs to be invested productively to compound that wealth into the future.

To most, it would seem reasonable that a modest distribution (approximately 5% or less of a portfolio) could be re-invested in short order into the investment program in accordance with the asset allocation targets. Transaction, trading, and administrative costs may make it inefficient to deploy this amount into the market in more than one tranche. But, what if the distribution represents 30%, 50%, or even 100% of the legacy portfolio? Would this - or should this - change the strategy?

Multiple Cash Deployment Options

Over the last 30+ years we have worked with many families to deploy large cash balances. A few examples include:

- A newly formed family office was funded with cash proceeds from an early stage venture investment

- A business owner sold an operating company and increased the size of the investment portfolio by over 400%

- An entrepreneur received liquidity from taking a startup public and wanted to retain a relatively high level of cash to fund future ventures

In our experience, the most common approaches to deploying large amounts of cash are (a) investing it in equal tranches over some specified period of time (typically quarterly or annually), or (b) investing it all at once. Markets typically go up over the long term so it seems intuitive that investors should become fully invested as quickly as possible. The longer the cash stays in the market, the larger it should grow. However, this simplistic view ignores the behavioral finance aspect of investing. Loss aversion is the idea that people experience losses more severely than the equivalent gains. This means investors feel worse losing 10% than they feel good about gaining 10%. As it relates to deploying cash, this concept leads many investors to prefer staging into the markets over time as opposed to investing it all at once.

What can we learn from history?

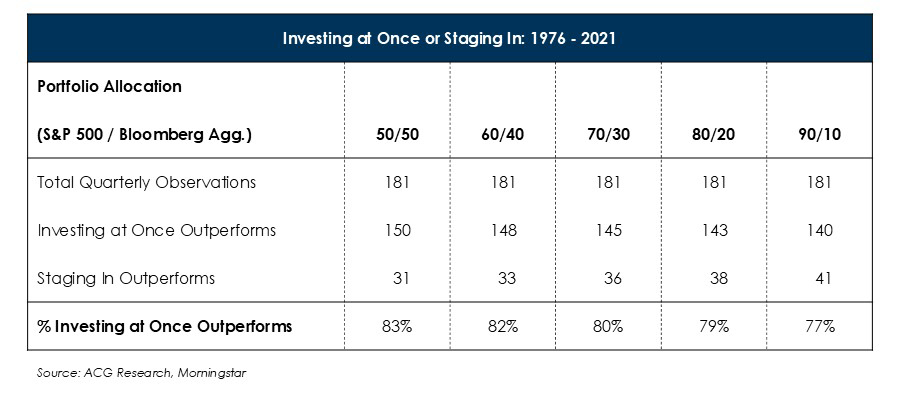

In an effort to evaluate the impact of investing all at once versus staging capital in over time, we analyzed hypothetical portfolio mixes invested in the S&P 500 and the Bloomberg US Aggregate Bond Index (Bloomberg Agg.) going back to 1976. We quantified the growth of a $100 portfolio on a quarterly basis that was either (a) invested in four quarterly increments of $25 each, or (b) invested entirely at the beginning of the quarter.

.jpg)

Key Observations

- Given that stocks are more volatile than bonds, the outperformance of investing a lump sum has historically decreased with a greater allocation to equities (from 83% of the time down to 77% of the time).

- Investors were better off staging into the market before large market corrections (e.g. Stock Market Crash of 1987, 2000 – 2002 Tech Bubble, 2007 – 2008 GFC), but predicting market peaks and troughs has proven very challenging.

- A blended portfolio (50/50 – 90/10) generated positive returns in roughly 75% of all quarters going back to 1976 regardless of the mix between stocks and bonds.

ACG’s Position

Excess cash will lose purchasing power over time due to inflation. However, investing in a diversified portfolio of stocks, bonds, and real assets still remains a critical means to maintain purchasing power and increase wealth over the long run. Empirical data shows investing cash all at once has generated better outcomes more than 75% of the time. In reality, however, all investors have some behavioral biases such as loss aversion and these cannot be ignored. We recommend investors with large amounts of cash develop a deployment strategy that aligns with their risk profile and stick to the plan – whether that means investing all at once or over the course of 12 months.