Industry Insights

US Small Caps – Where Has the Alpha Gone?

November 2025

- In Q3 2025, the median US small cap manager underperformed the Russell 2000 Index by the widest margin in over 20 years

- Higher interest rates and a proliferation of private equity are two factors contributing to the underperformance

- Opportunities remain in small cap for patient investors with a long-term approach to the asset class

Background

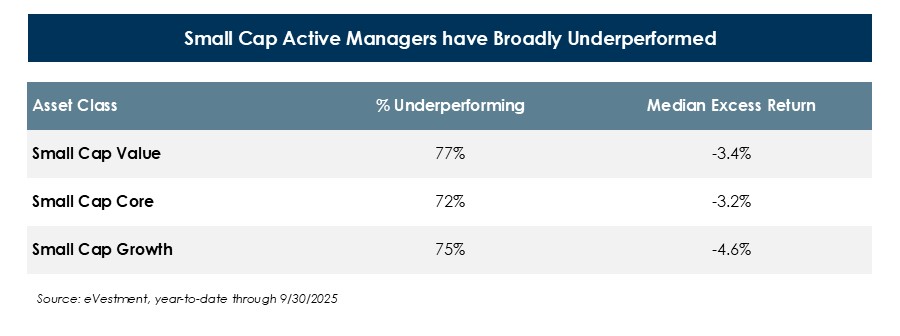

“Successful investing” is often relative, and, over the past decade, most major public equity indexes have produced historically-strong returns. US small cap equity, as measured by the Russell 2000 index, has generated solid absolute returns (+9.4% annualized over 10 years) but has underwhelmed in the shadow of US large cap dominance (+14.6% annualized over the same period). Of further concern among small cap investors has been manager alpha, or lack thereof, as roughly 75% of active managers have underperformed their benchmark year-to-date in 2025 by an average of 3-4%.

Evolution of the Small Cap Opportunity Set

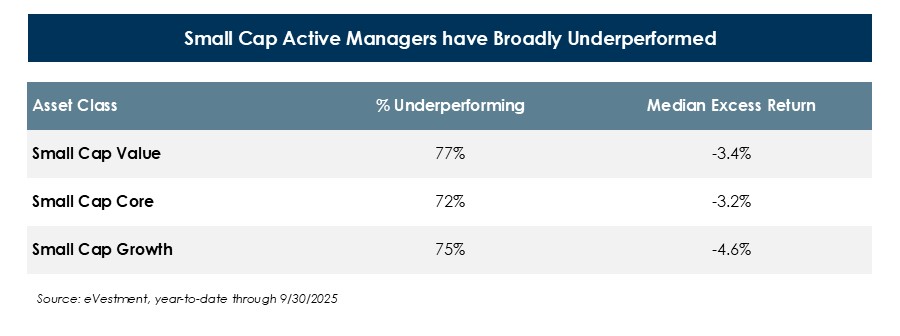

Historically, active managers have benefitted from several tail winds in US small cap, including a wider universe of companies to select from (2000 companies in small cap vs. 500 in large cap), a lack of analyst coverage which leads to more companies being mispriced, and finally, a steady stream of new public companies (IPOs), that continuously refresh the small cap opportunity set.

Over the past two decades, flows into private equity funds have grown. Easier access to capital has enabled smaller private companies to defer or delay public listing via IPO. As companies remain private for longer, and ultimately list as mid-cap or large-cap companies, the universe of smaller public companies for active managers to select from has shrunk.

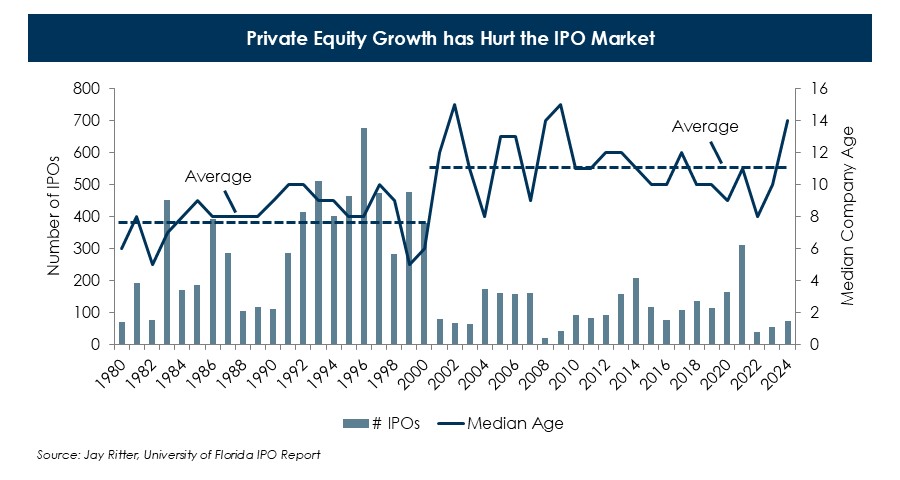

By design, the Russell 2000 comprises roughly 2,000 stocks. Successful, profitable companies may grow too large for inclusion in the small cap index while declining companies may be reclassified down from large cap to small cap. This dynamic, coupled with lower IPO issuance, has led to an increased weight of non-earning (unprofitable) Russell 2000 constituents.

Over the past two decades, flows into private equity funds have grown. Easier access to capital has enabled smaller private companies to defer or delay public listing via IPO. As companies remain private for longer, and ultimately list as mid-cap or large-cap companies, the universe of smaller public companies for active managers to select from has shrunk.

By design, the Russell 2000 comprises roughly 2,000 stocks. Successful, profitable companies may grow too large for inclusion in the small cap index while declining companies may be reclassified down from large cap to small cap. This dynamic, coupled with lower IPO issuance, has led to an increased weight of non-earning (unprofitable) Russell 2000 constituents.

Where Has the Alpha Gone?

“High quality” generally refers to financially-healthy companies with proven business models and high return on equity. Active managers that focus on these fundamentals have not been rewarded of late. Rather, small cap market momentum has been squarely behind lower-quality, more speculative companies, particularly in industries poised to benefit from AI-related investments (e.g. data center construction, utilities, energy, etc.), and those that may be supported by lower interest rates. AI-exuberance, driven more by lofty expectations than profits, has drawn comparisons to the 1999 dotcom bubble.

.jpg) ACG’s Position

ACG’s Position

The pursuit of success can be difficult in the short run, and it appears the alpha has been channeled toward non-earners in small cap. Over the long run, however, the market tends to reward growth and profitability. Managers with clearly defined, repeatable processes, and patience should be best positioned to outperform.

This material is provided for informational purposes only and is not a recommendation or solicitation to buy or sell any security or investment strategy. Additional important information and disclosures are included in the PDF Version with Full Disclosure linked, above.