Industry Insights

Viral Adaptation – Three Years of Market Evolution

March 2023

- Three years since the inception of the Covid pandemic, market adaptation remains a work in process

- Inflation and monetary policy drive daily volatility, but additional risks could arise

- Despite volatility, major indices have experienced gains that are consistent with longer-term trends

A Long Road Since 2020

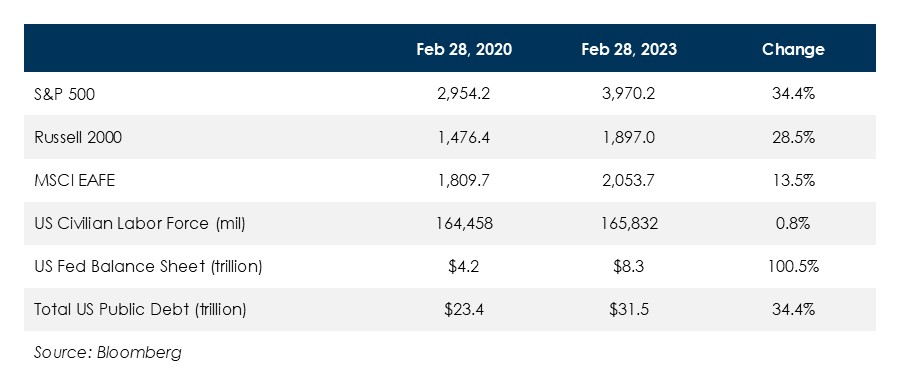

When we first wrote about Covid in 2020, it was impossible to know exactly how markets would respond and what long-term economic impacts would take hold. Three years later, following more than 6.8 million global deaths attributed to Covid, focus has shifted from the virus itself toward lasting changes in markets and the economy. The economic impact from stressed supply chains, rising inflation, and shifts in global consumption has clearly been reflected within the market and its volatility. Despite roaring gains in 2021, and significant losses in 2022, several markets have generated performance over the last three years in line with longer-term trends. An investor who only viewed the table below might not realize the amount of dislocation involved in getting to where we are today.

.jpg)

Economic Adjustment

In 2020, we highlighted that the predominant economic concerns surrounding Covid were the impact on global growth, supply chain disruptions, and the effects of consumers’ decisions to stay home. Inflation impacts have lasted longer than most originally anticipated, but inflation has also been elevated by non-Covid issues such as the war in Ukraine. Some markets have already completed their inflationary round trip and returned to more normal levels. An example of this is found in the shipping industry. The Drewry World Container Index, which tracks freight costs of containers via eight major routes has now mostly normalized after seeing prices spike by roughly 600% at their peak.

The Global Supply Chain Pressure Index, which is used by the Fed to gauge disruptions caused by delay in goods, has also returned to a level close to its average value after having peaked in December 2021.

Despite the normalization seen in the Drewry Container Index and the Global Supply Chain Pressure Index, inflation remains elevated in other parts of the economy. Additionally, Covid supply chain disruptions have had a lasting impact on thinking around product sourcing and inventory, leading to increased efforts at onshoring of critical manufacturing (i.e. microchips) and increased interest in carrying larger inventories. Following decades of corporate interest in containing expenses through inventory reduction, “justin-time” inventory management has lost some of its allure.

Fed Dominance

Recent market volatility has centered on inflation and expectations around Fed policy. Other market risks, such as the war in Ukraine, US/China relations, and the US debt ceiling, loom as potential triggers of market stress, but have not captured the same level of day-to-day investor attention as the Fed. In addition, the expansion of the Fed balance sheet via quantitative easing during Covid more than doubled the value of assets held by the Fed. This extended the Fed’s ownership of Treasury and MBS assets, making the Fed a dominant owner of these sectors.

Investment Implications

Markets have adapted to significant dislocations over the last three years and many markets have normalized, but investors should be prepared for additional challenges. Some new economic patterns are likely to endure into the future, and investment risks did not end with the 2022 drawdown. Fed policy and inflation are driving attention, but a well-diversified, thoughtfully-planned portfolio can help investors weather inflation, monetary policy, and any other risks that arise.