Industry Insights

What’s Next for the US Dollar?

April 2025

- The Trump administration’s tariffs have been far broader than anticipated, causing significant market disruption

- The US dollar has weakened as the trade war has escalated, the opposite expected impact of protectionist policy

- Disrupting long-established trade relationships could have unintended side effects for the US dollar

Trump 2.0 Was Expected to Strengthen the Dollar

President Trump was elected on a platform of trade protectionism, a policy which is typically expected to strengthen the home currency. In theory, tariffs reduce the demand for foreign goods. This means fewer dollars being exchanged with other countries into the currency market, and a lower supply means a higher price – assuming demand stays constant.

While protectionism was expected, financial markets have been shocked at the breadth and magnitude of Trump’s tariff announcements, culminating in the April 2nd announcement of a 10% baseline tariff along with massive “reciprocal” tariffs for most countries. The tariffs have caused the opposite expected currency reaction, with the US dollar weakening substantially as the trade war has escalated.

One potential reason for a weaker dollar is markets are now expecting the US economy to slow materially. Relative economic strength is a key factor in currency exchange rates as goods and capital flow toward growing economies. Retaliatory tariffs also can offset currency appreciation as the counter-tariffs have the opposite currency effect. Retaliation has been somewhat limited, with the exception of China, but the expectation is for a meaningful reordering of global trade if tariffs remain, one that potentially could see less outside investment in US assets.

While protectionism was expected, financial markets have been shocked at the breadth and magnitude of Trump’s tariff announcements, culminating in the April 2nd announcement of a 10% baseline tariff along with massive “reciprocal” tariffs for most countries. The tariffs have caused the opposite expected currency reaction, with the US dollar weakening substantially as the trade war has escalated.

One potential reason for a weaker dollar is markets are now expecting the US economy to slow materially. Relative economic strength is a key factor in currency exchange rates as goods and capital flow toward growing economies. Retaliatory tariffs also can offset currency appreciation as the counter-tariffs have the opposite currency effect. Retaliation has been somewhat limited, with the exception of China, but the expectation is for a meaningful reordering of global trade if tariffs remain, one that potentially could see less outside investment in US assets.

.JPG) The US Dollar’s Central Role in Global Trade

The US Dollar’s Central Role in Global Trade

Trump paused all reciprocal tariffs (except China) for 90 days to allow target countries to negotiate deals. Financial markets breathed a sigh of relief and the dollar briefly rebounded in response. Still, the remaining 10% tariff and other country and sector specific tariffs that remain constitute the largest tariff hike in decades. Even if tariffs eventually return to near 2024 levels or lower, it is possible the policy unpredictability demonstrated by the US will lead to permanent structural changes as countries seek more reliable trade partners.

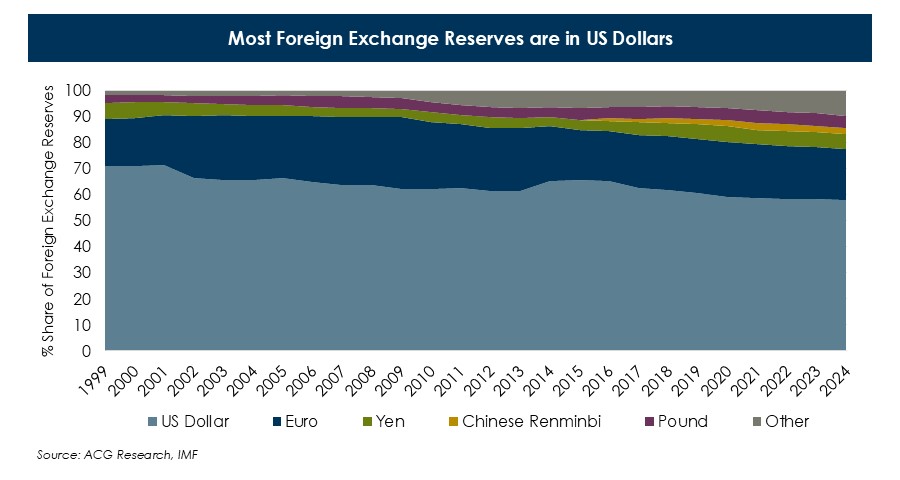

The US dollar has been the world’s primary means of exchange since WWII, making it the most frequent currency used in international trade as well as the most commonly held reserve currency. This comes with costs as well as benefits. The cost primarily falls on US exporters, as a highly valued dollar makes exports more expensive and worsens the trade deficit. Conversely, the high demand for dollars helps the US government issue debt at a lower cost as foreign holders of US dollars invest that cash into US assets. The central role of the dollar also increases the potency of US sanctions against other nations.

Geopolitical considerations such as friction with China and Russia have already seen the dollar’s dominance come into question as countries seek to blunt the potential impact of US sanctions. But few other currencies can match the stability, economic growth, and liquid bond market that the US can offer. While the size of US dollar reserves has shrunk modestly in recent decades, it is still far and away the leading reserve currency. However, with the current trade war, the US has antagonized allies and adversaries alike. It will continue to be difficult to supplant the dollar as the leading reserve currency, but this has perhaps accelerated the trend of other currencies sharing influence with the US dollar.

Economists debate exactly what the repercussions would be of the dollar losing its reserve status, with some downplaying the issue, pointing to the similarly low rates other developed nations pay to borrow. However many economists fear it would greatly reduce the borrowing capacity of the US, along with eroding the country’s leadership position in the global financial system.

.JPG)

The US dollar has been the world’s primary means of exchange since WWII, making it the most frequent currency used in international trade as well as the most commonly held reserve currency. This comes with costs as well as benefits. The cost primarily falls on US exporters, as a highly valued dollar makes exports more expensive and worsens the trade deficit. Conversely, the high demand for dollars helps the US government issue debt at a lower cost as foreign holders of US dollars invest that cash into US assets. The central role of the dollar also increases the potency of US sanctions against other nations.

Geopolitical considerations such as friction with China and Russia have already seen the dollar’s dominance come into question as countries seek to blunt the potential impact of US sanctions. But few other currencies can match the stability, economic growth, and liquid bond market that the US can offer. While the size of US dollar reserves has shrunk modestly in recent decades, it is still far and away the leading reserve currency. However, with the current trade war, the US has antagonized allies and adversaries alike. It will continue to be difficult to supplant the dollar as the leading reserve currency, but this has perhaps accelerated the trend of other currencies sharing influence with the US dollar.

Economists debate exactly what the repercussions would be of the dollar losing its reserve status, with some downplaying the issue, pointing to the similarly low rates other developed nations pay to borrow. However many economists fear it would greatly reduce the borrowing capacity of the US, along with eroding the country’s leadership position in the global financial system.

ACG’s Position

Trump has promised additional sector specific tariffs are coming soon. Combined with ongoing negotiations with individual countries and potential retaliations, it is safe to expect more policy-based volatility in the near-term. Should negotiations fail, recent history suggests a re-escalation of the trade war would be met with more dollar weakness. Longer-term, higher trade barriers would diminish the US role in global trade and provide momentum to move away from the dollar as the global reserve currency. This would potentially raise borrowing costs for the US, putting upward pressure on bond yields. A scenario where successful negotiations result in lowered trade barriers would be a positive for global growth and likely result in near-term dollar strengthening. This scenario still potentially ends with diminished trust in the US as a trading partner and a desire to diversify global reserves, but the continued importance of the US to the global economy would likely see the US dollar maintain a dominant role. Currency fluctuations can be a key driver of relative performance across geographic exposures, and regardless of trade war outcomes a portfolio that is globally diversified will be best suited to weather market uncertainty.

This material is provided for informational purposes only and is not a recommendation or solicitation to buy or sell any security or investment strategy. Additional important information and disclosures are included in the PDF Version with Full Disclosure linked, above.