Industry Insights

2025 Private Equity Review & 2026 Outlook

February 2026

- Private equity deal and exit activity rebounds with mega deals across buyout and venture capital leading the way

- Sponsors test public markets for liquidity despite mixed post-IPO stock performance

- Fundraising continues a downward trend as investors consolidate manager lineups to proven, well-established firms

2025 Review

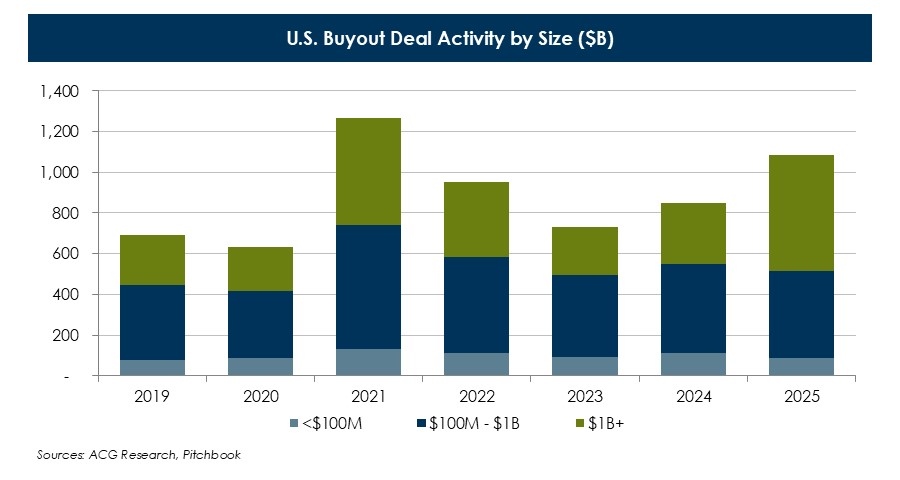

U.S. buyout activity experienced a choppy 2025 despite positive market sentiment post election day in 2024. Liberation Day’s unexpected tariff announcements and ensuing volatility led to a brief pause in deal volume. Activity rebounded in the second half with total 2025 deal value surpassing $1 trillion for the second time in history (2021). Deals over $1 billion reached new highs in 2025 and were the main catalyst for the resurgence. 150 “mega-deals” falls just shy of 2021’s total, but aggregate transaction value of $560+ billion surpassed 2021’s $528 billion.

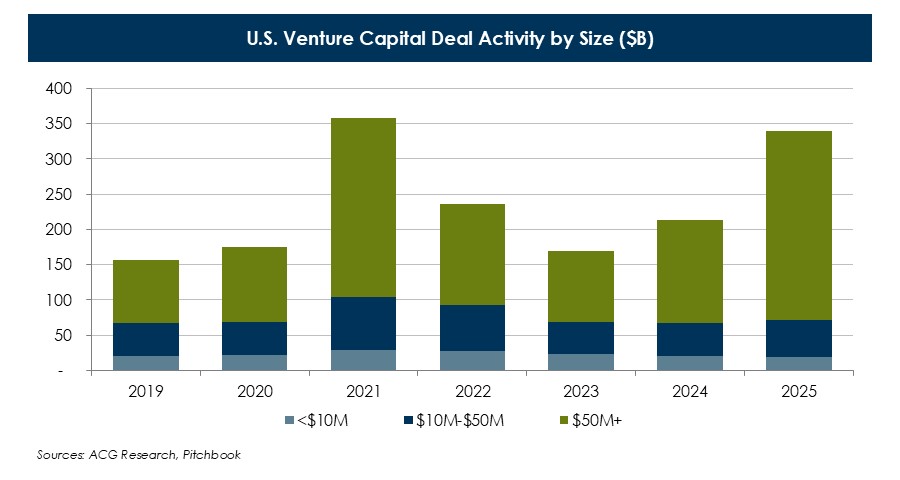

Venture capital deal activity also recovered in 2025 with its second consecutive year of growth. Similar to buyout, deal activity across venture capital was sustained by large, late-stage transactions. Late-stage venture capital and growth deal value rose 131% year over year. A small number of extremely outsized deals primarily in the artificial intelligence sector (OpenAI, Anthropic, Databricks) seized an oversized share of total capital.

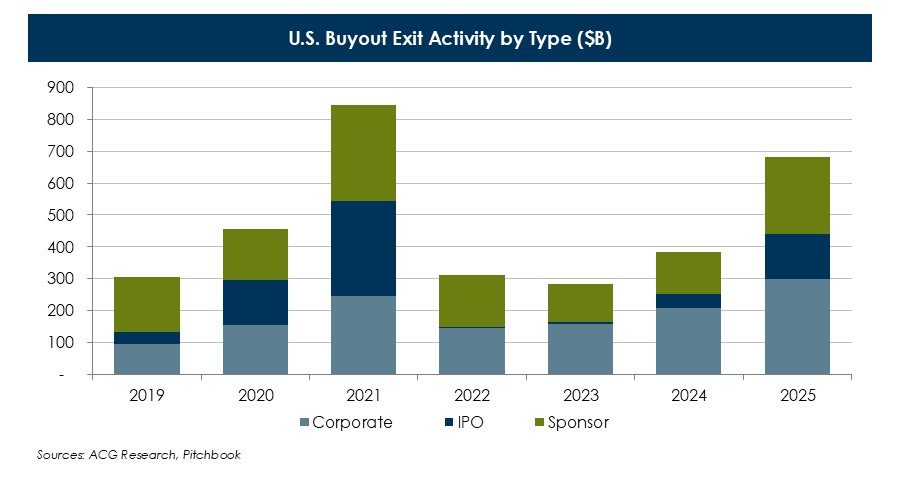

Buyout exit activity gained traction in 2025 across all transaction types. Corporate acquisitions continued, sponsors dipped into record amounts of dry powder to acquire assets, and the IPO window is creaking open after seeing a 3x+ increase in exit value in 2025. Despite exit activity dropping in the second and third quarter post Liberation Day, total volume fell just shy of $700 billion. Sponsors continue to utilize “liquidity tools” such as dividend recaps and continuation vehicles (GP-led secondaries). These vehicles grew 51% in 2025 to $106 billion of volume.

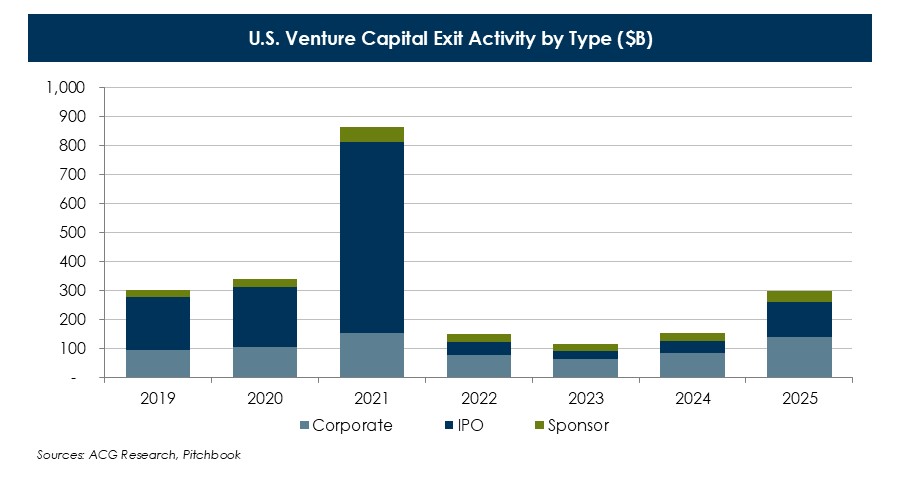

Venture capital exit activity began showing signs of life in 2025. Relative to 2024, realizations increased but still fell short of pre-Covid and 2021 highs. The IPO window opened for certain sectors such as artificial intelligence and crypto (CoreWeave, Circle, Chime). The secondary market within venture capital grew rapidly as 2025 set highs for both direct and GP-led activity. Sponsors and allocators continued to seek alternative liquidity paths to combat another slow year of realizations.

Venture capital deal activity also recovered in 2025 with its second consecutive year of growth. Similar to buyout, deal activity across venture capital was sustained by large, late-stage transactions. Late-stage venture capital and growth deal value rose 131% year over year. A small number of extremely outsized deals primarily in the artificial intelligence sector (OpenAI, Anthropic, Databricks) seized an oversized share of total capital.

Buyout exit activity gained traction in 2025 across all transaction types. Corporate acquisitions continued, sponsors dipped into record amounts of dry powder to acquire assets, and the IPO window is creaking open after seeing a 3x+ increase in exit value in 2025. Despite exit activity dropping in the second and third quarter post Liberation Day, total volume fell just shy of $700 billion. Sponsors continue to utilize “liquidity tools” such as dividend recaps and continuation vehicles (GP-led secondaries). These vehicles grew 51% in 2025 to $106 billion of volume.

Venture capital exit activity began showing signs of life in 2025. Relative to 2024, realizations increased but still fell short of pre-Covid and 2021 highs. The IPO window opened for certain sectors such as artificial intelligence and crypto (CoreWeave, Circle, Chime). The secondary market within venture capital grew rapidly as 2025 set highs for both direct and GP-led activity. Sponsors and allocators continued to seek alternative liquidity paths to combat another slow year of realizations.

2026 Outlook

- Dealmaking conditions stabilized in the second half of 2025 and should continue to improve in 2026 with recent Federal Reserve rate cuts, tariff policy clarity, and record levels of dry powder across private equity.

- Early-stage venture capital activity picked up late in 2025, and 2026 should be an active year for this segment of the market.

- Liquidity tools are a mainstay for sponsors. However, improved market sentiment should lead to an increasing share for traditional asset sales.

- Fundraising bifurcation will continue as proven, well-established firms gain market share over new and emerging managers. Allocators trimming manager lineups could lead to limited capacity for mature firms but also provide an opportunity to back up-and-coming or spin-out teams.

This material is provided for informational purposes only and is not a recommendation or solicitation to buy or sell any security or investment strategy. Additional important information and disclosures are included in the PDF Version with Full Disclosure linked, above.