Industry Insights

The Glittering Return of Precious Metals

February 2026

- Gold & silver spot prices have reached all-time highs due to looser monetary policy, central bank buying, and geopolitical concerns

- Precious metals provide portfolio diversification benefits and can improve portfolio outcomes in certain market environments

- Investors considering precious metals exposure need to weigh the pros/cons carefully and size the allocation appropriately

A Historical Perspective on the Recent Rally

The financial world has been captivated by a spectacular rally in precious metals. Gold and silver have shattered historical price ceilings, driven by a potent mix of economic anxiety and geopolitical instability. A look back at history provides essential context for understanding the role of these assets in a modern portfolio, weighing their powerful hedging capabilities against significant risks and periods of underperformance.

The past two years have witnessed an extraordinary repricing of precious metals. Building on momentum from 2024, gold prices soared throughout 2025, eclipsing the $5,000 per ounce mark in early 2026. Silver recently surged past $100 per ounce for the first time in history.

This dramatic ascent has been fueled by a convergence of powerful forces, foremost among them being monetary policy shifts. As central banks have moved from aggressive tightening to a cycle of rate cuts, the opportunity cost of holding non-yielding assets like gold and silver has fallen, making them more attractive. Simultaneously, heightened geopolitical uncertainty (from ongoing conflicts to renewed trade tensions) has reasserted the traditional role of precious metals as the ultimate safe-haven asset.

Additionally, a structural shift in demand has provided a strong floor for prices. Global central banks have been buying gold at a record pace, diversifying their reserves away from the U.S. dollar due to concerns over the mounting U.S. national debt.

The past two years have witnessed an extraordinary repricing of precious metals. Building on momentum from 2024, gold prices soared throughout 2025, eclipsing the $5,000 per ounce mark in early 2026. Silver recently surged past $100 per ounce for the first time in history.

This dramatic ascent has been fueled by a convergence of powerful forces, foremost among them being monetary policy shifts. As central banks have moved from aggressive tightening to a cycle of rate cuts, the opportunity cost of holding non-yielding assets like gold and silver has fallen, making them more attractive. Simultaneously, heightened geopolitical uncertainty (from ongoing conflicts to renewed trade tensions) has reasserted the traditional role of precious metals as the ultimate safe-haven asset.

Additionally, a structural shift in demand has provided a strong floor for prices. Global central banks have been buying gold at a record pace, diversifying their reserves away from the U.S. dollar due to concerns over the mounting U.S. national debt.

The Case for Precious Metals

As physical commodities, gold and silver are distinct from financial assets and are uniquely suited in hedging against systemic risks:

- Hedge Against U.S. Dollar Weakness – Gold and silver are globally recognized stores of value that are historically negatively correlated with the U.S. dollar. When the dollar's purchasing power declines, the price of metals in dollar terms tends to rise.

- Inflation Protection – While not a perfect short-term inflation hedge, over long periods, precious metals have maintained their purchasing power. During the stagflation of the 1970s, gold prices skyrocketed as inflation eroded the value of paper currency and stock returns stagnated.

- Portfolio Diversification During Equity Declines – In times of severe stock market stress or financial crises, gold has historically demonstrated a negative correlation to equities, often rising in value while stock prices tumble. This low correlation can significantly reduce overall portfolio volatility and cushion losses during bear markets.

Risks and Potential Underperformance

Investing in gold and silver is not without significant risks and drawbacks that investors must carefully consider. Unlike stocks and bonds that pay dividends and interest, gold and silver produce no income. Without cash flows or earnings to analyze, determining the "intrinsic value" of a precious metal is notoriously difficult, often relying on sentiment, technical analysis, and macroeconomic conjecture. Precious metals can also be dramatically volatile, with rapid price declines that can shake out all but the most steadfast of investors.

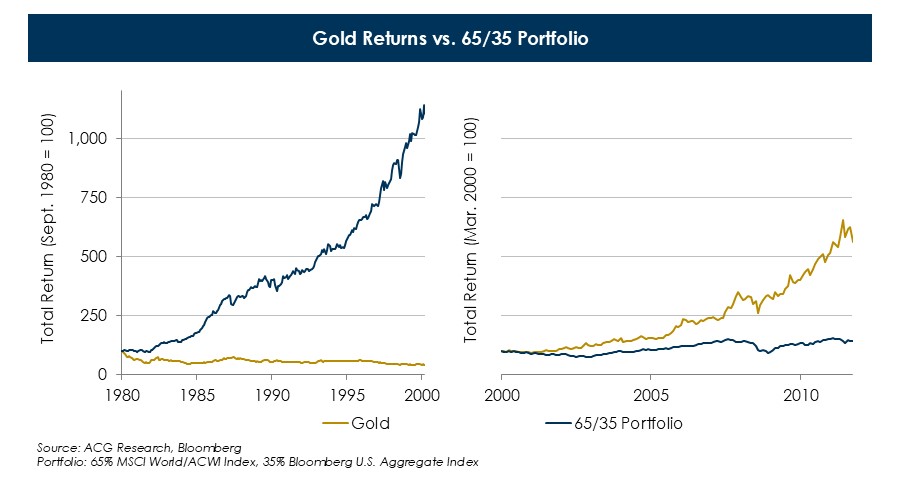

Lastly, history shows that gold can lag behind stocks and bonds for extended periods. During times of economic stability, low inflation, and strong corporate earnings growth, capital tends to flow into productive assets, leaving metals out of favor. To illustrate this point, consider the period from the early 1980s to roughly 2000 (left chart).

After peaking in 1980, gold entered a two-decade bear market. During this time, the U.S. economy experienced a long boom, inflation was tamed, and the stock market enjoyed one of its greatest bull runs in history. An investor heavily allocated to gold during this period would have seen dismal returns compared to a standard 65/35 stock and bond portfolio. Conversely, the period from 2000 to 2011 (right chart) saw gold vastly outperform stocks, which were battered by the dot-com crash and the 2008 financial crisis. This cyclical nature is a defining characteristic of precious metals.

Lastly, history shows that gold can lag behind stocks and bonds for extended periods. During times of economic stability, low inflation, and strong corporate earnings growth, capital tends to flow into productive assets, leaving metals out of favor. To illustrate this point, consider the period from the early 1980s to roughly 2000 (left chart).

After peaking in 1980, gold entered a two-decade bear market. During this time, the U.S. economy experienced a long boom, inflation was tamed, and the stock market enjoyed one of its greatest bull runs in history. An investor heavily allocated to gold during this period would have seen dismal returns compared to a standard 65/35 stock and bond portfolio. Conversely, the period from 2000 to 2011 (right chart) saw gold vastly outperform stocks, which were battered by the dot-com crash and the 2008 financial crisis. This cyclical nature is a defining characteristic of precious metals.

Investing in Gold & Silver

The most direct method for investors to add precious metal exposure is to buy physical coins or bars. This eliminates counterparty risk but comes with costs for storage, insurance, and dealer premiums. Alternatively, Exchange-Traded Funds (ETFs) that hold physical gold/silver offer a convenient, liquid, and low-cost way to track the spot price without the hassle of handling physical metal. It is also possible to achieve indirect exposure to precious metals by investing in mining companies. Mining stocks can offer "leverage" to the metal's price, meaning their profits and stock prices can rise much faster than the metal itself during a bull market. However, they also carry company-specific risks (operational issues, geopolitical jurisdiction risk, management execution) which can increase price volatility.

ACG’s Position

Precious metals offer powerful protection against monetary debasement and market turmoil, but they are not a one-way bet. Investors considering precious metals should size the allocation appropriately within their portfolio’s overall strategic allocation by balancing the potential diversification benefits against the added volatility that accompanies this asset class.

This material is provided for informational purposes only and is not a recommendation or solicitation to buy or sell any security or investment strategy. Additional important information and disclosures are included in the PDF Version with Full Disclosure linked, above.

This material is provided for informational purposes only and is not a recommendation or solicitation to buy or sell any security or investment strategy. Additional important information and disclosures are included in the PDF Version with Full Disclosure linked, above.